- PayFi Weekly

- Posts

- 46 Billion New Reasons To Love Stablecoins ♥️

46 Billion New Reasons To Love Stablecoins ♥️

Welcome to PayFi Weekly.

Last week has been quite eventful (in every sense of the word).

Transak sponsored TOKEN2049 Singapore

UK lifted ban on crypto assets

Tether CEO comes out with a wild forecast for stablecoins

…and so much more!

We’ll cover all of this in here.

Let’s start with $46 billion dollars.

💱 Stablecoin Snapshot

$46 BILLION flooded into stablecoins last quarter and stablecoins proved that a new class of utility is emerging!

For centuries, money barely evolved. It moved faster, got safer, went digital… but never smarter. Programmability was the missing piece.

The lack of programmability in money kept finance locked in a one-dimensional world of deposits, transfers, and reconciliations.

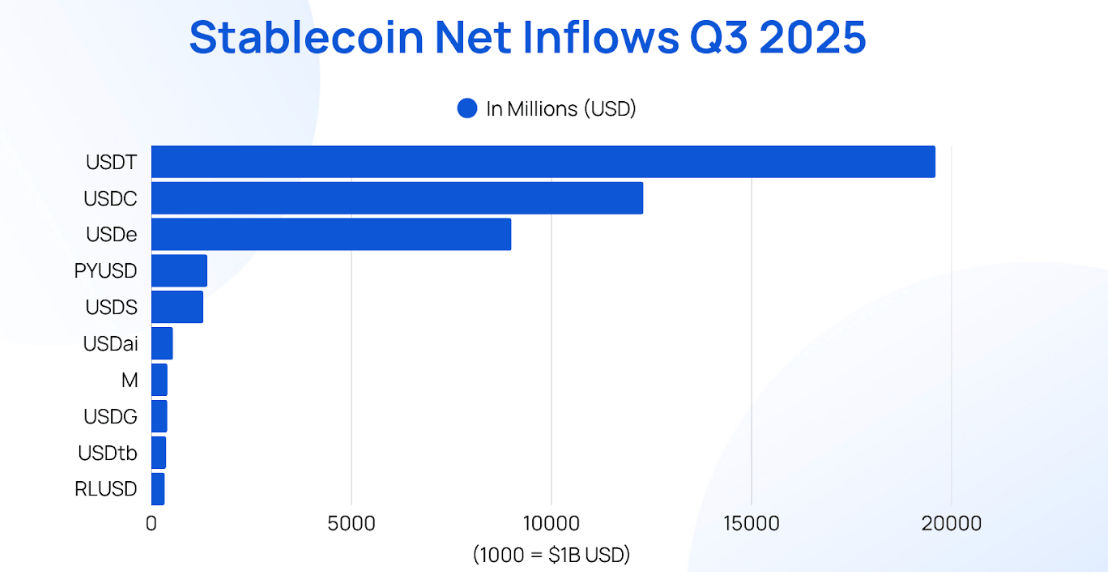

That changed with stablecoins. Over $46 billion flowed into stablecoins in Q3 2025 (a 324% jump over Q2). But the real breakthrough isn’t the inflow. It’s who is moving the money.

Source: RWA.xyz

More than 70% of all stablecoin transactions last quarter were executed by bots, not humans. These autonomous agents are settling trades, managing liquidity, and triggering payments with machine precision.

What we’re witnessing is the birth of programmable finance. A world where code, not clerks, performs transactions. Here, AI agents can hold, send, and optimize capital without friction.

Stablecoins are the operating system for a new economy where every transaction can carry logic, intention, and intelligence.

⚖️ Regulation

🇬🇧 The UK’s FCA lifted its ban on retail investors purchasing crypto exchange-traded products (ETPs/ETNs). However, retail investors may still face delays before they can actually access these crypto-linked products. 👉 Read more

🇻🇳 Vietnam’s crypto pilot has attracted zero applicants so far, due to steep capital requirements and exclusion of stablecoins and tokenized securities. 👉 Read more

🇰🇿 Kazakhstan is piloting both the digital tenge CBDC and a state-backed Evo stablecoin, positioning them as complementary, not rival, systems. 👉 Read more

🌍 Adoption

🏦 Standard Chartered estimates up to $1 trillion could shift from emerging market bank deposits into US-backed stablecoins. 👉 Read more

🇪🇺 An EU watchdog reportedly pushed for banning stablecoins issued jointly across jurisdictions, potentially targeting issuers like Circle and Paxos. 👉 Read more

🛠 Tech & Partnerships

🔮 Bitwise’s CIO predicts Solana will become Wall Street’s preferred blockchain for tokenization and stablecoin issuance, due to its speed and finality. 👉 Read more

🦓 Stripe’s new Open Issuance tool lets companies create and manage custom stablecoins with minimal code, using infrastructure from Bridge, BlackRock, Fidelity, and Superstate. 👉 Read more

🌍 Everything Else

💲 Tether co-founder Reeve Collins forecasts that by 2030, all money (including dollars, euros, yen) will essentially operate as stablecoins on blockchain rails. 👉 Read more

💱 Visa is piloting the use of USDC and EURC stablecoins for instant cross-border payouts, enabling banks to pre-fund transfers with digital assets. 👉 Read more

🚶 World’s tallest man, Sultan Kösen, receives a Ledger Stax from Transak for competing in Transak Stable Hands challenge at TOKEN2049 Singapore.

💌 Like our content? Share it across! PayFi Weekly by Transak

Reply