- PayFi Weekly

- Posts

- 🚀 Bitcoin breaks records. What’s driving this surge?

🚀 Bitcoin breaks records. What’s driving this surge?

Welcome back to PayFi Weekly!

You couldn’t script a better week for crypto. Welcome back to PayFi Weekly by Transak!

Bitcoin Breaks Records Amid U.S. “Crypto Week”

In a moment of poetic timing, Bitcoin surged past $123,000 (at the time of writing) this week (setting a new all-time high) just as the U.S. House declared July 14–18 “Crypto Week.”

But what’s driving this surge?

Momentum is being driven by regulatory clarity, as lawmakers debate bills like the GENIUS Act and CLARITY Act, signaling a green light for institutional adoption.

At the same time, record inflows into Bitcoin ETFs from BlackRock and Fidelity, plus treasury buys from firms like Japan’s Metaplanet, show growing conviction.

Add to that macro tailwinds: dovish inflation signals, Trump’s tariff policies, and global monetary instability and Bitcoin is reclaiming its role as a hedge and reserve asset on the world stage.

💱 Stablecoin Snapshot

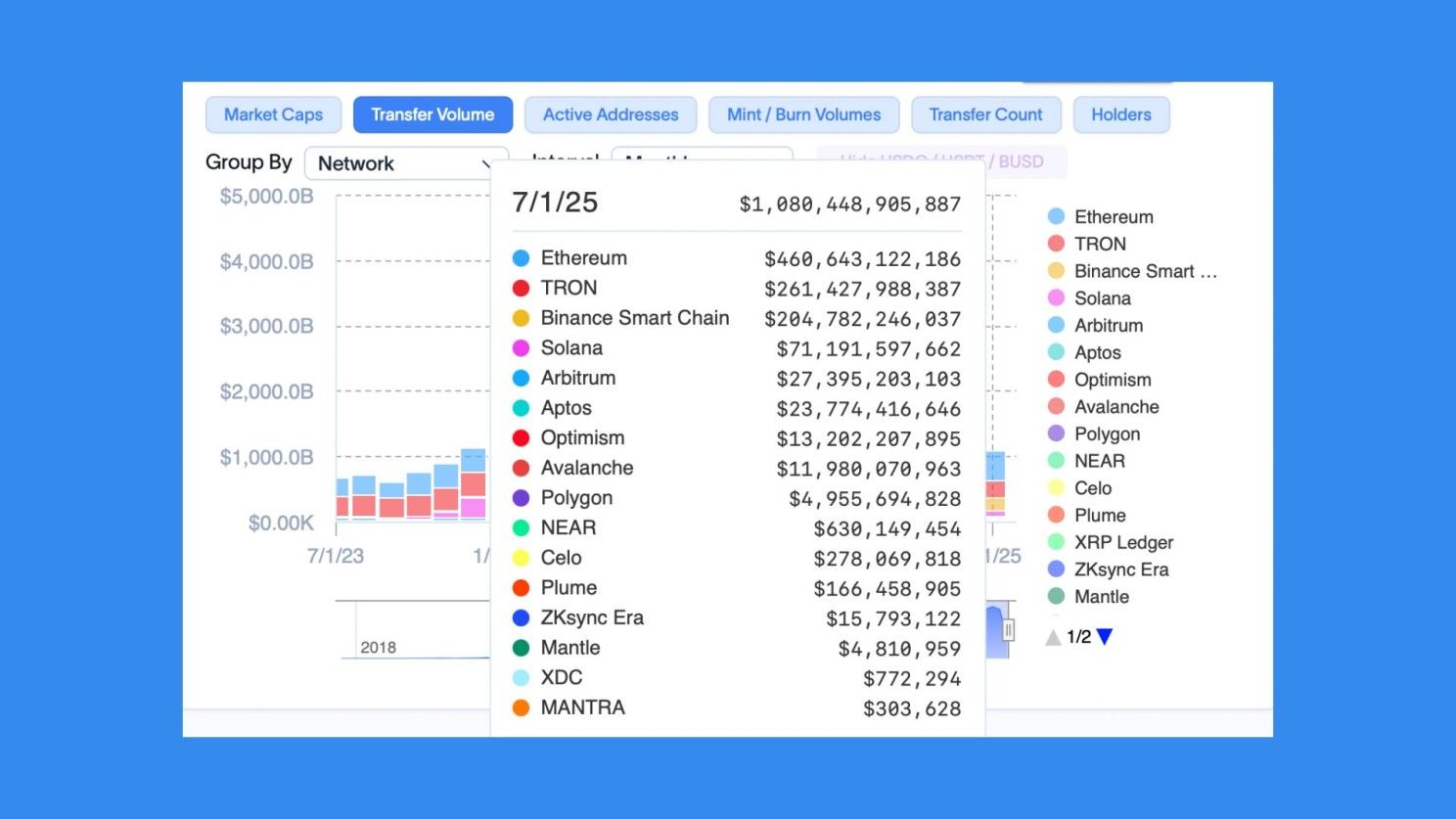

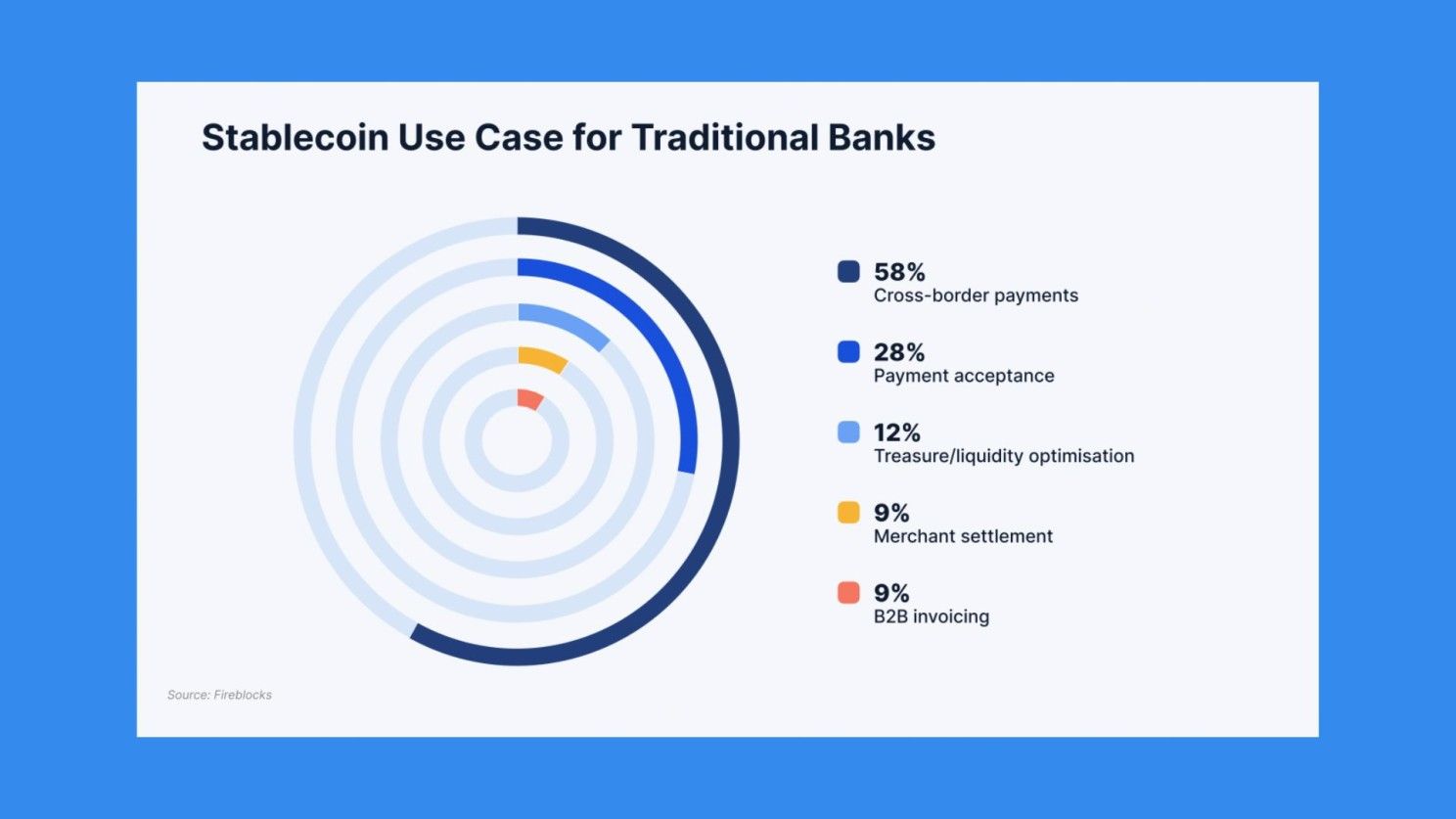

Stablecoins are doing what traditional finance couldn’t: fixing cross-border payments. With a nearly $250B market cap, dominated by Tether ($156B) and USDC ($61B), stablecoin transfer volume crossed $1 trillion in just the first half of July 2025.

⚖️ Regulation

🏛️ The House Financial Services Committee released a detailed report on stablecoin oversight, urging stricter consumer protections, transparent reserves, and federal regulatory clarity. It’s a key step in shaping forthcoming crypto legislation. Read the report

🧑⚖️ Grayscale is suing the SEC over its surprise hold on the launch of the Grayscale Digital Large Cap Fund (GDLC) ETF, insisting the stay order is "unlawful" and harming investors. Its legal team argues the SEC exceeded its authority and that approval should proceed by statute. Read more

🟡 Binance reportedly covertly developed and promoted the Trump-backed stablecoin USD1, enabling a $2 billion investment through an Abu Dhabi firm while CZ Zhao pursued a presidential pardon. The partnership raises fresh ethical and conflict-of-interest concerns. Discover full story

🌍 Adoption

U.S. lawmakers (GENIUS Act) and the EU (MiCA) are creating a green light for adoption. Stablecoins adoption, 88% of North American businesses say regulation now gives them clarity. Read the report

㊗️ Shanghai’s state assets regulator is exploring a yuan-pegged stablecoin. Major firms like JD.com and Ant Group are pushing for pilot programs in Hong Kong. Discover more

💰 ZeroHash raised $100 million at a $1 billion valuation to build stablecoin infrastructure, backed by Interactive Brokers. The raise reflects rising institutional demand for crypto-native financial plumbing. Explore more

🛠 Tech & Partnerships

🇦🇪 Crypto.com and Dubai Duty Free signs MoU to enable crypto payments at Dubai airports and retail spots. Supports Dubai’s D33 plan to drive smart financial systems. Learn more

🔴 Circle is integrating native USDC and CCTP V2 into the Sei Network, enabling seamless 13-chain cross-chain transfers. The upgrade will deepen DeFi and payment use cases on Sei. Explore details

🐜 Ant Group plans to bring USDC to its AntChain platform once regulatory approvals are in place. This marks a major step toward cross-border tokenized finance by a Chinese fintech giant. Discover details

🌍 Everything Else

🤑 Nasdaq-listed BTC Digital has set aside a $1 million ETH reserve with plans to scale, signaling a strategic shift toward Ethereum. The move reflects rising institutional interest in smart-contract ecosystems. Learn the details

🔷 The Cardano Foundation spent over $15 million on adoption efforts in 2024, including tie-ups with NASA, Barcelona FC, and UNDP. This accounts for more than half its annual budget to push real-world utility. Explore the report

Subscribe to PayFi Weekly to receive the most crucial crypto payments news directly in your inbox every Monday.

Let's shape the future of finance, one byte at a time.

Reply