- PayFi Weekly

- Posts

- Circle Loves Privacy... But With Regulation? What’s Cooking!? 🧐

Circle Loves Privacy... But With Regulation? What’s Cooking!? 🧐

Welcome to PayFi Weekly by Transak.

We have a packed week again!

MiCA rewired Europe’s stablecoin market, regulators rolled out fresh rules, new national coins launched, and legacy giants started plotting their stablecoin plays. 🌍

Let’s jump in! 👇

💱 Stablecoin Snapshot

This week, we’re zooming into the euro-pegged stablecoin scene and why it’s becoming a big deal.

If you’re tracking digital money, this one matters 💡

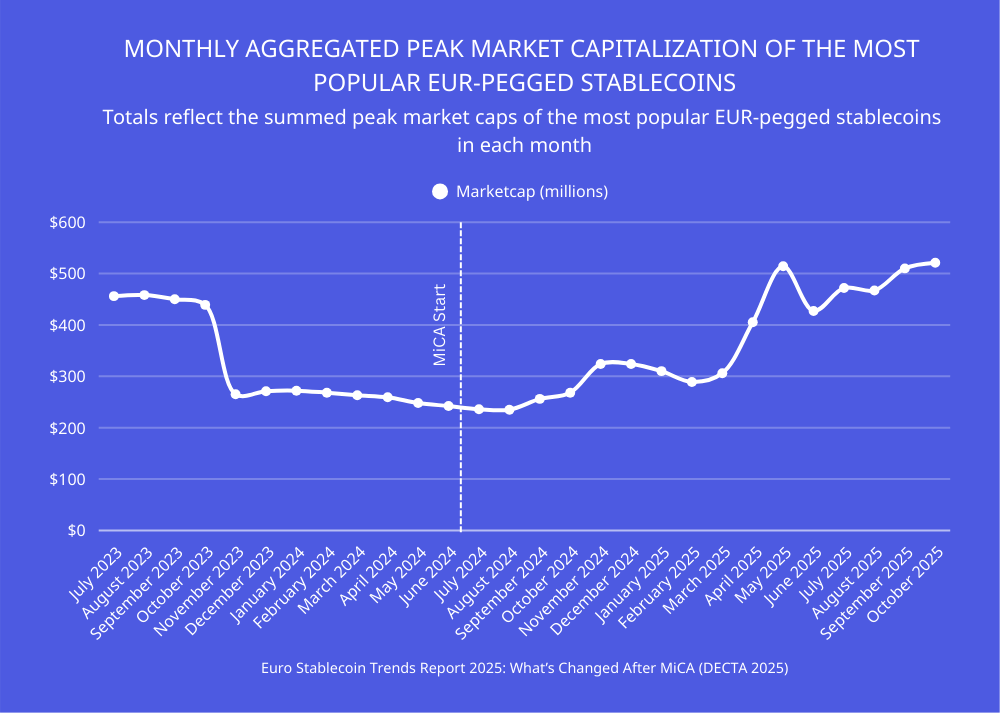

DECTA just dropped new data after one full year of MiCA, and the conclusion we derive from it is “regulation didn’t kill euro-stablecoins, it revived them. ⚡️”

Euro-pegged stablecoin market cap has doubled since MiCA came into force.

Monthly transaction volume is now almost 10x higher than before the rules kicked in.

Consumer interest across Europe is rising fast, especially in markets like Finland and Italy.

That’s the story. MiCA gave issuers a proper rulebook, and users responded with trust.

This isn’t about euro-coins becoming bigger than USD ones. It’s about the euro finally showing real traction in the digital money race.

If you’re in payments or stablecoin infra, this matters because it signals a future where regional currencies don’t get left behind.

⚖️ Regulation

🇦🇪 Circle lands a Financial Services Permission license in the Financial Services Regulatory Authority of the Abu Dhabi Global Market to operate as a Money Services Provider in the UAE. 👉 Read more

🇦🇺 The Australian Securities and Investments Commission (ASIC) expands class-relief exemptions for intermediaries distributing eligible stablecoins and wrapped tokens, easing licensing while tightening reserve and redemption disclosure rules. 👉 Read more

🌍 Adoption

🇲🇾 Malaysia’s crown prince backs the launch of a ringgit-pegged stablecoin, RMJDT, on the Zetrix network and sets up a Rm. 500 million (~US $121 m) digital assets treasury under a regulatory sandbox. 👉 Read more

💎 xMoney announces three upcoming fiat-backed stablecoins (EURXM, USDXM, RONXM) scheduled for June 2026, to be integrated into its payment gateway and card infrastructure and initially launched on the Sui Network. 👉 Read more

🛠 Tech & Partnerships

🔵 Circle develops a new privacy-enabled version of its USDC stablecoin, called USDCx, in collaboration with Aleo to enable private transactions while adhering to regulatory standards. 👉 Read more

🟢 Tether and HoneyCoin partner to expand stablecoin access across Africa, deploying infrastructure to support on-ramp and off-ramp services for local users. 👉 Read more

🌍 Everything Else

🏦 Western Union plans to launch a “Stable Card” and issue its own stablecoin as part of a payments strategy focused on emerging markets, aiming to leverage its global remittance network. 👉 Read more

🧓 A senior executive at Polygon predicts a “stablecoin super-cycle,” suggesting the number of distinct stablecoins could reach 100,000 as issuance ramps up amid global tokenization trends. 👉 Read more

💌 Like our content? Share it across! PayFi Weekly by Transak

Reply