- PayFi Weekly

- Posts

- Solana’s Comeback! Bleeds $400M, Then Gets Its Own ETF 🔥

Solana’s Comeback! Bleeds $400M, Then Gets Its Own ETF 🔥

Welcome to PayFi Weekly!

This week, we have a looong “Adoption” section.

What does that mean?

That’s right! - Another irrefutable evidence that stablecoins are the value carriers of the next generation!

But just as we started euphorically high, recent on-chain activity kept our feet glued to the ground. Let’s take a look… 👇

💱 Stablecoin Snapshot

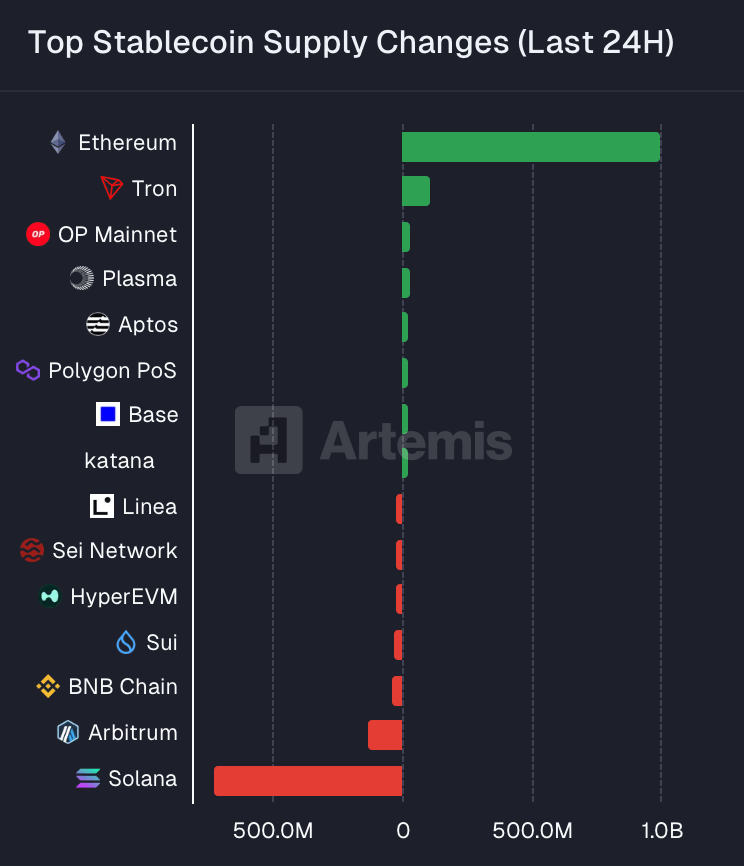

Crypto hit the brakes this week and stablecoins followed.

Major chains saw millions of dollars worth of stablecoins exit the ecosystem within hours!

Solana took most of the impact with $400 million stablecoin outflow in three days, of which $36.1 million was pulled in a single day on October 17.

Most of that liquidity came from USDT and USDC being bridged out. A clear sign that traders are playing it safe after the recent $130 billion market cap wipeout across crypto.

But why is this happening?

💡 Our best guess: The Fear & Greed Index is flashing 25 (Extreme Fear). This signals a classic risk-off behavior with investors rotating into “safer” zones like Ethereum and Bitcoin spot positions.

Still, don’t mistake rotation for retreat. Solana’s engine is very much alive!

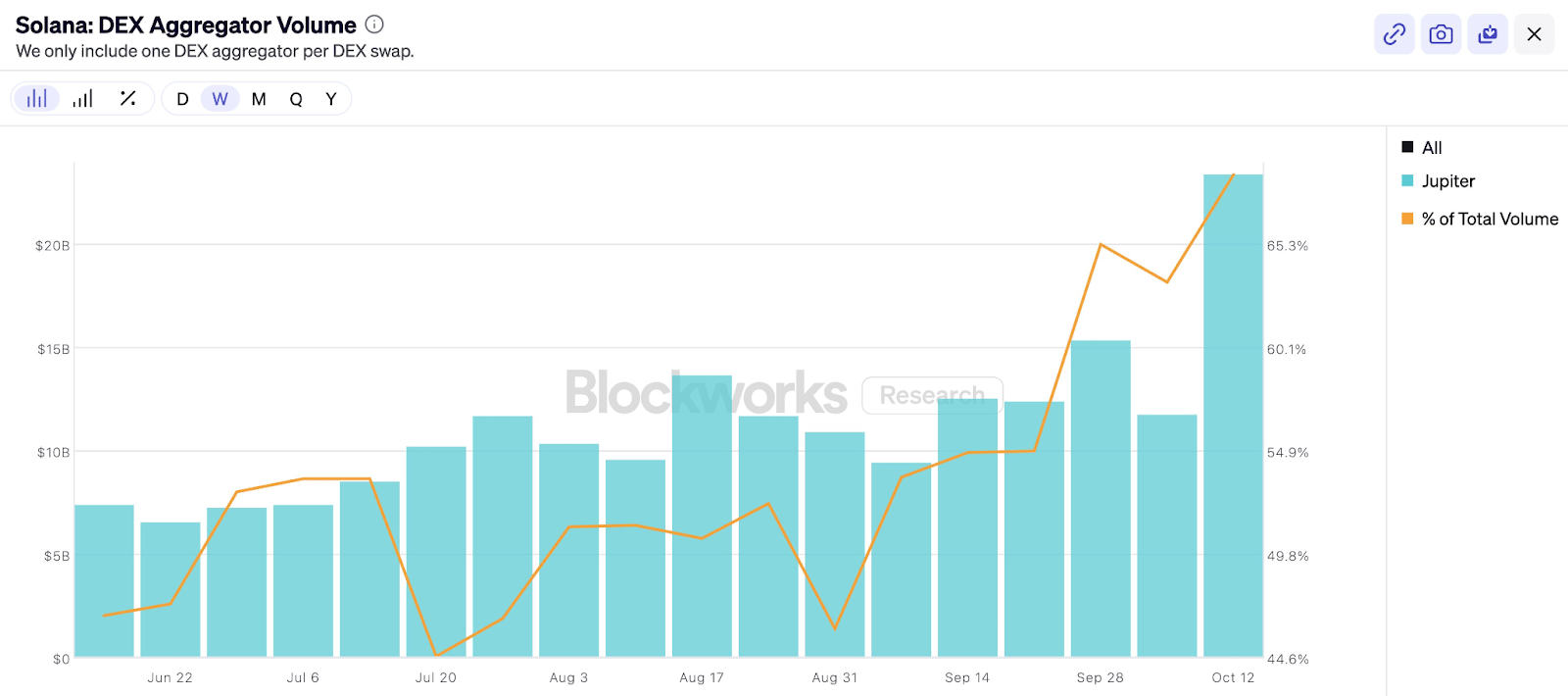

🪐 Jupiter’s DEX volume is crushing competitors

📃 Tokenized stock trading crossed $1.1 billion

💰 ETFs on Solana remain steady at $400 million in assets

Source: X

Above all, Solana spot ETF is now approved (more in the next section)!

So, despite the on-chain metrics, the long-term prospect for Solana is looking very bright!

⚖️ Regulation

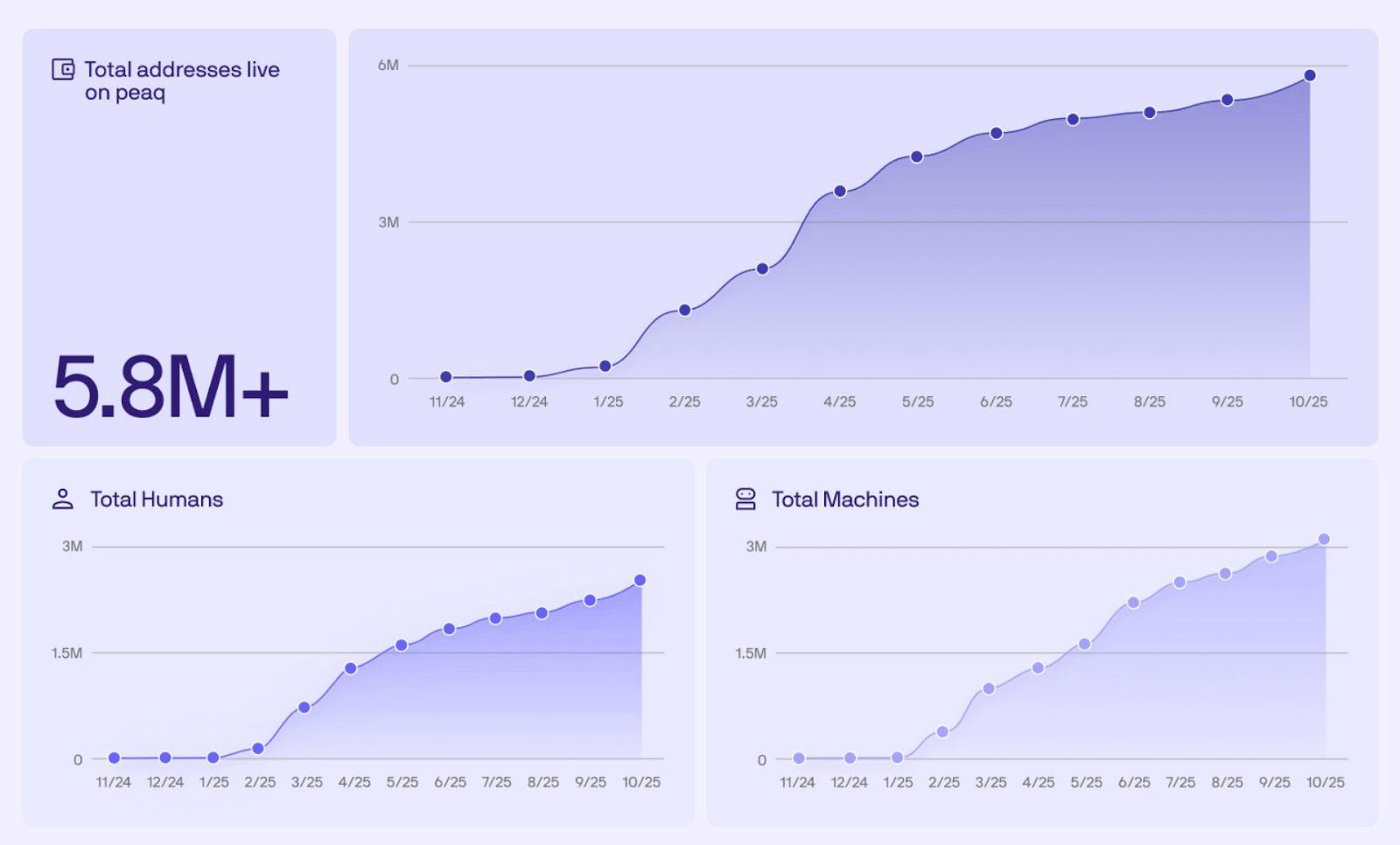

🇦🇪 Dubai’s VARA partners with peaq to regulate the “machine economy,” enabling tokenized robots, AI, and DePIN projects under a compliant framework. 👉 Read More

Source: peaq

🇺🇸 Florida lawmakers propose allowing state pension funds to invest up to 10% in Bitcoin and digital-asset ETFs, signaling growing institutional crypto adoption. 👉 Learn More

🇺🇸 The U.S. Securities and Exchange Commission (SEC) has approved the Form 8-A for 21Shares’ spot ETF tracking Solana (SOL). Analysts say this opens the door for more spot crypto ETFs and could boost Solana’s price toward ~$300 if momentum continues. 👉 Find Out More

🌍 Adoption

💪 Stripe’s blockchain arm, Tempo, raises $500M at a $5B valuation to power stablecoin and payment infrastructure. 👉 See Details

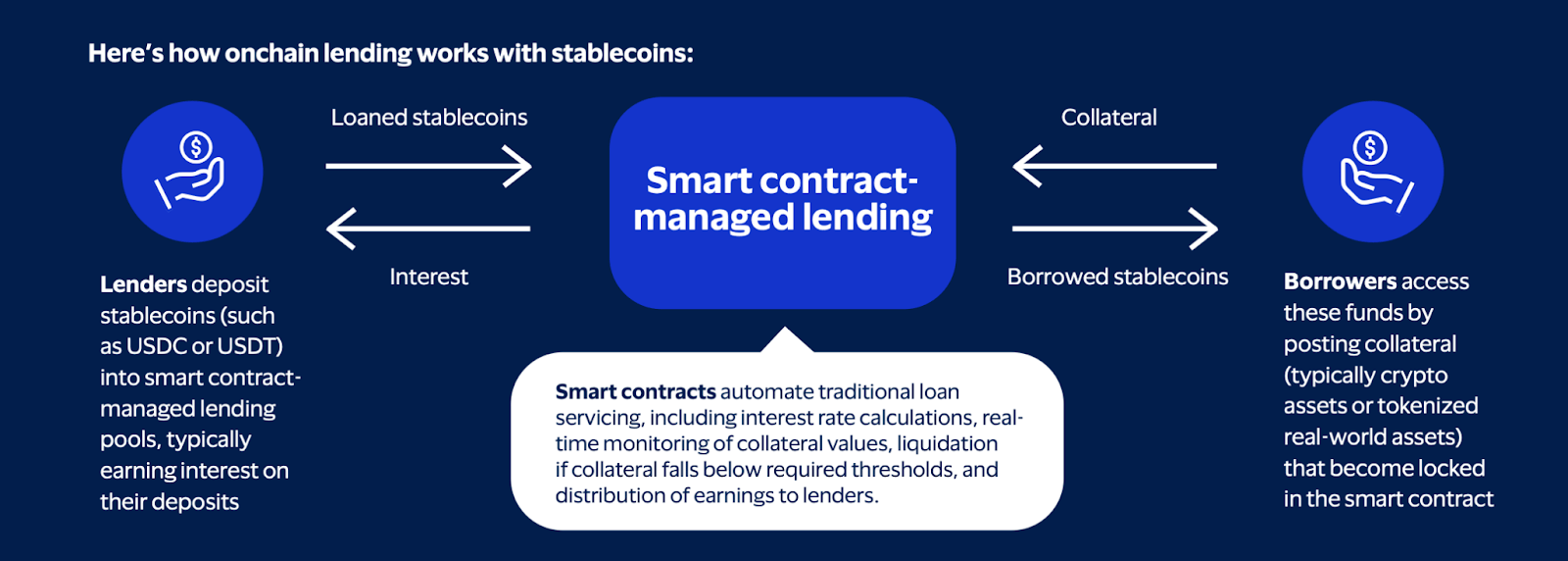

📄 Visa’s whitepaper explores stablecoins’ $670B on-chain lending market and how they could transform global credit systems. 👉 Read Paper

🇯🇵 Japan’s biggest banks join forces to issue a yen-backed stablecoin for digital settlements and interbank payments. 👉 Full Story

💹 Visa projects stablecoins could reshape the $40T credit market, integrating programmable money into traditional finance. 👉 Explore More

💸 BlackRock refocuses a fund to serve stablecoin issuers, deepening its crypto strategy and linking TradFi to digital assets. 👉 Read More

🇩🇪 Franco-German bank ODDO BHF launches a euro-pegged stablecoin, strengthening Europe’s digital asset settlement ecosystem. 👉 Learn More

🛠 Tech & Partnerships

💙 Coinbase launches new business payment tools supporting stablecoin transactions and crypto-based settlement options for enterprises. 👉 View Blog

💚 Robinhood expands tokenization to 500+ U.S. stocks and ETFs on Arbitrum, bridging traditional and crypto markets. 👉 See Update

🌍 Everything Else

🤑 Paxos Trust Company accidentally minted approximately US$300 trillion worth of excess PYUSD stablecoins in an internal transfer, far exceeding global dollar circulation and even double the world’s estimated GDP. 👉 Read Story

🧑🏫 Ethereum researcher Dankrad Feist joins Stripe’s Tempo blockchain, boosting its technical strength and credibility. 👉 Read More

💱 TRON strengthens its position as global settlement infrastructure in Q3 2025, leading on-chain transaction volumes. 👉 View Report

💌 Like our content? Share it across! PayFi Weekly by Transak

Reply