- PayFi Weekly

- Posts

- When JP Morgan Bets on Stablecoins, You Pay Attention💡

When JP Morgan Bets on Stablecoins, You Pay Attention💡

Welcome to PayFi Weekly by Transak.

What started as code is now colliding with central banks. Last week marked a big moment where stablecoins, Bitcoin, and real-world finance finally intersected!

Before we dig into what's turning out to be the most eventful quarter for stablecoins (and global finance in general), here's a quick recap of the stablecoin market and its performance.

Stablecoin Snapshot

Last month, we saw key shifts as the GENIUS Act gave stablecoins clear rules in the U.S., adding $4 billion to their market cap. Big players like J.P. Morgan and Bank of America are jumping in.

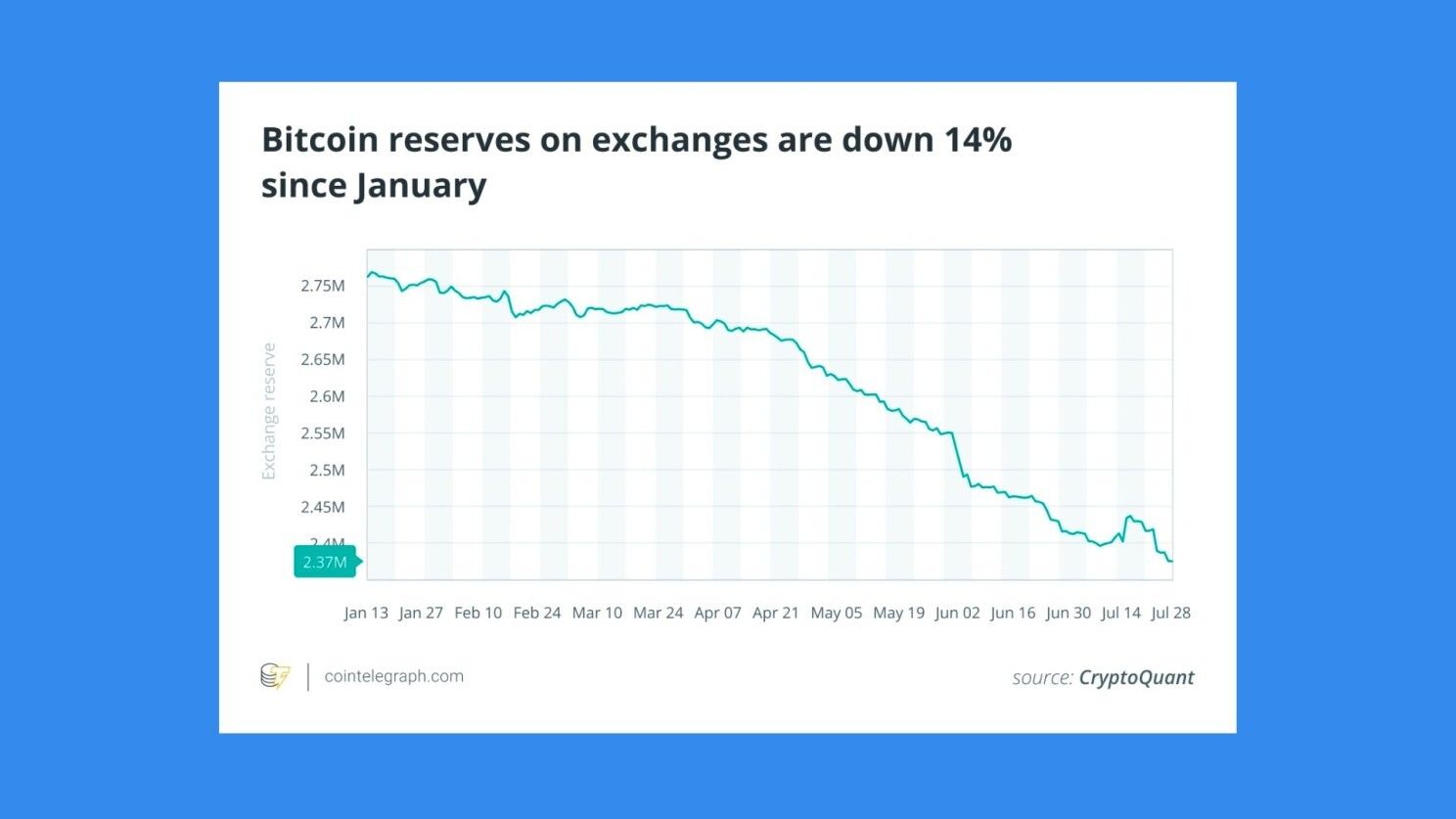

But, Bitcoin reserves on exchanges fell to a 7-year low, with just 15% of BTC still on exchanges. This could mean a supply crunch is coming.

And, Tokenized real-world assets grew by 2.6%, showing that traditional finance is getting even more into Web3.

It’s all coming together: stablecoins, Bitcoin scarcity, and tokenized assets are setting the stage for what’s next in digital finance. Dig into the report here

⚖️ Regulation

🇭🇰 Hong Kong fintech companies raised over $1.5 billion in July 2025, driven by new stablecoin regulations requiring issuers to obtain licenses. Read more

🇩🇪 AllUnity, a joint venture involving DWS, Galaxy, and Flow Traders, has introduced EURAU, a euro-denominated stablecoin approved under Germany's BaFin regulatory framework. Read the full article

🏛️ Senators have raised concerns with the Office of the Comptroller of the Currency (OCC) regarding potential conflicts of interest involving Donald Trump’s involvement in the stablecoin sector. Read the full article

🌍 Adoption

💳 PayPal introduced "Pay with Crypto," allowing U.S. merchants to accept payments in over 100 cryptocurrencies, including Bitcoin and Ethereum. This initiative aims to reduce cross-border transaction costs by up to 90%. Learn more

🌐 Asia is emerging as a global crypto powerhouse, with stablecoins like USDT and PYUSD gaining traction across the region.

💳 Visa has broadened its stablecoin settlement capabilities to include PayPal USD (PYUSD), USD Global (USDG), and Euro Coin (EURC) across Avalanche and Stellar networks. Dive deeper here

🛠 Tech & Partnerships

🤝 JP Morgan Chase and Coinbase are collaborating to enable features like direct bank-to-wallet connections, ability to transfer Chase Ultimate Rewards points to Coinbase, and the use of Chase credit cards for crypto purchases. Read more here

🔗 FIS has partnered with Circle to integrate USDC functionality into its Money Movement Hub, enabling financial institutions to facilitate stablecoin transactions. Explore now

🪙 Stable, a blockchain optimized for USDT transactions, has secured $28 million in seed funding from KuCoin Vantures and others. Stable is built with USDT as its native asset. Learn more

🌍 Everything Else

🏦 SEC Chairman Paul Atkins announced "Project Crypto," a deregulatory initiative aimed at integrating digital assets into traditional financial markets. Learn more

Source: X

🇬🇧 The UK's Financial Conduct Authority (FCA) has lifted its ban on cryptocurrency exchange-traded notes (cETNs) for retail investors, effective October 8, 2025. Discover more

🧾 Trump Media disclosed plans for a utility token named "Truth," integrated into a digital wallet for its Truth+ streaming service. The company also announced a $2 billion Bitcoin investment. Read more here

Subscribe to PayFi Weekly to receive the most crucial crypto payments news directly in your inbox every Monday.

Let's shape the future of finance, one byte at a time.

Reply