- PayFi Weekly

- Posts

- YouTube Creators Now Paid In Stablecoins?! ➡️

YouTube Creators Now Paid In Stablecoins?! ➡️

Welcome to PayFi Weekly by Transak.

Welcome to PayFi Weekly by Transak!

Crypto markets are shaky. Stablecoins are not.

While everything else chops sideways, digital dollars just crossed a new all time high and pulled regulators, banks, and payment giants deeper onchain.

There’s also some juicy stuff happening over at YouTube. What is the video giant up to?

Find out more in this week’s newsletter 👇

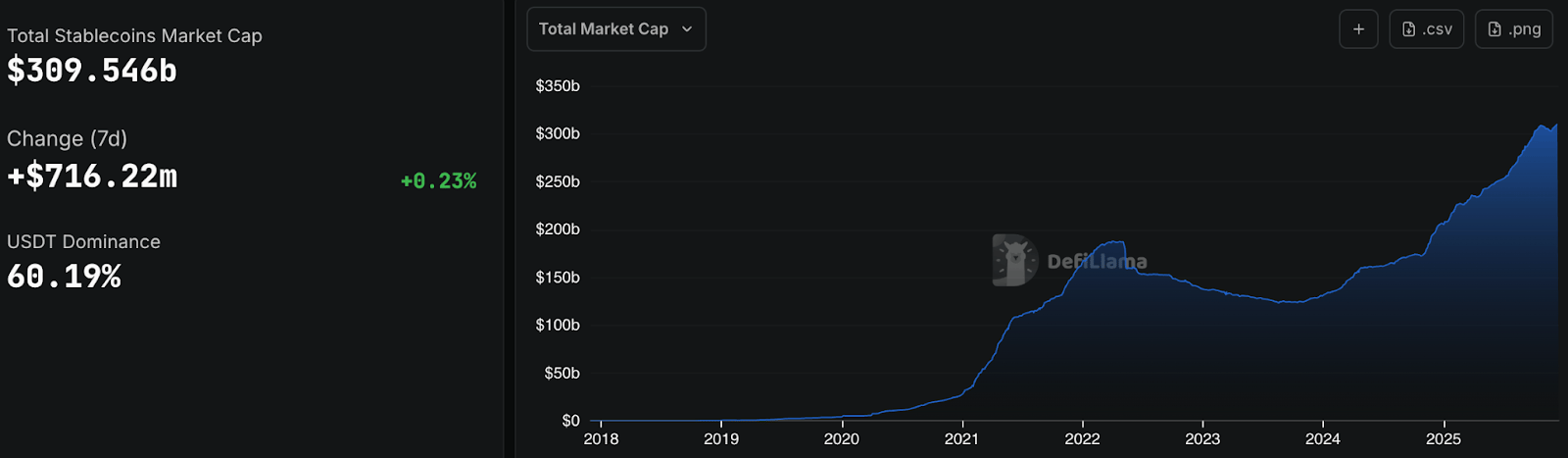

💱 Stablecoin Snapshot

Total stablecoin market cap has climbed to ~$310 billion, setting an all time record, even as broader crypto markets wobble. The takeaway is clear. Demand for digital dollars keeps growing across trading, payments, remittances, and DeFi.

A few things stand out 👇

USD dominance is absolute. Nearly 99% of all stablecoins are USD-pegged, reinforcing the dollar’s role as the default unit of account onchain.

Two players still run the show. USDT and USDC control over 90% of total stablecoin supply.

Innovation is happening at the edges. Yield-bearing and synthetic stablecoins are growing fast, even if they are still small in absolute terms.

Source: DeFiLlama

Top stablecoins by market cap (mid-Dec 2025):

USDT: ~$186B (~60% market share)

USDC: ~$78B

Others: USDe, DAI, RLUSD and newer entrants filling the rest, with momentum shifting toward programmable and yield-linked models

Big number. Bigger signal.

Stablecoins are no longer reacting to crypto cycles.

They are building their own.

⚖️ Regulation

🇬🇧 The UK’s Financial Conduct Authority is prioritising stablecoin payment frameworks and sandbox testing ahead of broader crypto rules expected by 2026 to support innovation and growth in digital finance. 👉 Read more

🇯🇵 Japan plans to regulate crypto under securities law instead of payments law, strengthening disclosures for issuers and cracking down on unregistered platforms in a major regulatory overhaul. 👉 Read more

🌍 Adoption

💳 Visa has launched a stablecoin advisory arm inside Visa Consulting & Analytics, helping banks and firms develop stablecoin products and integrating them into payments and settlement infrastructure. 👉 Read more

🇵🇰 Pakistan signed an MoU with Binance to explore tokenising up to $2B in sovereign and real-world assets as it prepares for a national stablecoin and crypto licensing regime. 👉 Read more

🇲🇾 Standard Chartered Malaysia and AirAsia parent Capital A agreed to test a ringgit-pegged stablecoin in a central bank innovation hub aimed at wholesale use cases under regulated frameworks. 👉 Read more

🛠 Tech & Partnerships

💰 PayPal’s PYUSD stablecoin deposit products have surged, helping grow stablecoin balances significantly within its ecosystem and reflecting increased consumer adoption of tokenised USD. 👉 Read more

🏦 Japan’s SBI Holdings is deepening blockchain tech and stablecoin engagement through partnerships (like Circle and Ripple) and exploring tokenised finance infrastructure across assets and payments. 👉 Read more

🎥 YouTube now lets U.S. content creators receive earnings in PayPal’s PYUSD stablecoin, expanding stablecoin utility in mainstream digital payments. 👉 Read more

🌍 Everything Else

🇷🇺 Sberbank, Russia’s largest bank, is testing DeFi products as customer interest in crypto grows, aiming to merge decentralised finance offerings with traditional banking services. 👉 Read more

💱 Bank of America says U.S. banks are trending toward on-chain finance, with stablecoins and tokenised deposits gaining regulatory clarity and pushing traditional finance onto blockchain rails. 👉 Read more

💌 Like our content? Share it across! PayFi Weekly by Transak

Reply